|

||||

|

LBAS Blog

Uncategorized

- Subscribe to this category

- Subscribe via RSS

- 4 posts in this category

Season Greetings

Wishing you a very happy Christmas, safe holiday season and all the best for the New Year.

From your team

Lee Business & Accounting Services

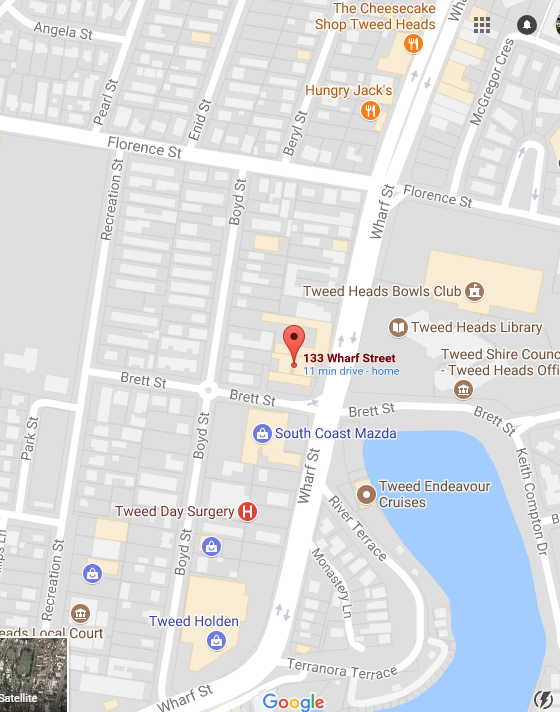

Our office will be closed from Friday 22nd December to Monday 8th January

Appointments may still be available outside these hours

It’s that time of the year again. Time to consider if you can claim a tax deduction for your staff Christmas party and gifts? Or are there Fringe Benefit tax obligations for the employer? How is a Cash Christmas Bonus treated?

The ATO have a basic article on their website for you to get a feel of the legislation: https://www.ato.gov.au/Newsroom/smallbusiness/General/Work-Christmas-parties-and-gifts/

Christmas Bonus

Any cash Christmas Bonus you give your current employee, will need to be included their payslip, have PAYG withheld and superannuation paid. This will be included in the payment summary earnings at the end of the financial year. Tax deductible, no FBT

Christmas party: It depends on the cost, whether it is held on or off the employer premises and where, and who it is for (employee, associates, suppliers, clients)

Christmas Gifts: It depends on the cost, type of gift, and who it is for (employee, associates, suppliers, clients)

Some Basic Pointers:

For EACH employee (or employee’s associate):

Gifts & Hampers (non-entertainment gifts):

• If the gift is $299 or less each, it is regarded as a minor Benefit and NOT tax deductible, no FBT

• If the gift is $300 or more each, it is regarded as an employee Benefit and is tax deductible, and FBT is payable by the employer

….For Clients & Suppliers, tax deductible, no FBT where a Minor gift – where an expectation it will motivate referral of your products or services

Parties (& entertainment Gifts)

• If the party is $299 or less each, it is regarded as a minor Benefit and NOT tax deductible, no FBT

• If the party is $300 or more each, it is regarded as an employee Benefit and is tax deductible, and FBT is payable by the employer

(If the party is on the employer’s business premises ON a working day, for the current employee only, it is regarded as an exempt property benefit NOT tax deductible, no FBT.)

….For Clients & Suppliers, NOT tax deductible, no FBT

Please refer to the following link for detailed consideration of clients, suppliers, employees & their associates: https://www.ato.gov.au/General/Fringe-benefits-tax-(FBT)/In-detail/Fact-sheets/FBT-and-Christmas-parties/?page=2

Taxi Travel: (To\from Christmas Party or Entertainment)

• Single Trip beginning and\or ending at employers employer’s business premises ON a working day, for the current employee, NOT tax deductible, no FBT.

• Otherwise: If the taxi and value of other associated entertainment benefits is $299 or less, it is regarded as a minor Benefit and NOT tax deductible, no FBT

If the taxi and value of other associated entertainment benefits is $300 or more, it is regarded as an employee Benefit and is tax deductible, and FBT is payable by the employer

Other Useful Links about entertainment gifts\parties: https://www.ato.gov.au/General/Fringe-benefits-tax-(fbt)/In-detail/Publications/FBT-and-entertainment-for-small-business/?page=4#What_is_entertainment_

This is general information only, and should not be relied upon without professional advice. Please call us on 07 5523 1159 for a consultation to clarify tax deductibility & FBT treatment relating to your particular business circumstances